“Whoever digs a pit will fall into it, and he who rolls a stone will have it roll back on him.” — Proverbs 26:27

In recent weeks, the global economy has found itself shaken by the reverberations of an intensifying economic conflict between the world’s two largest economies: the United States and China. This escalating trade war, marked by tit-for-tat tariffs and nationalist posturing, is doing more than just strain bilateral relations—it is sending shockwaves across global markets, undermining confidence, disrupting supply chains, and threatening to plunge the world into a deeper economic downturn.

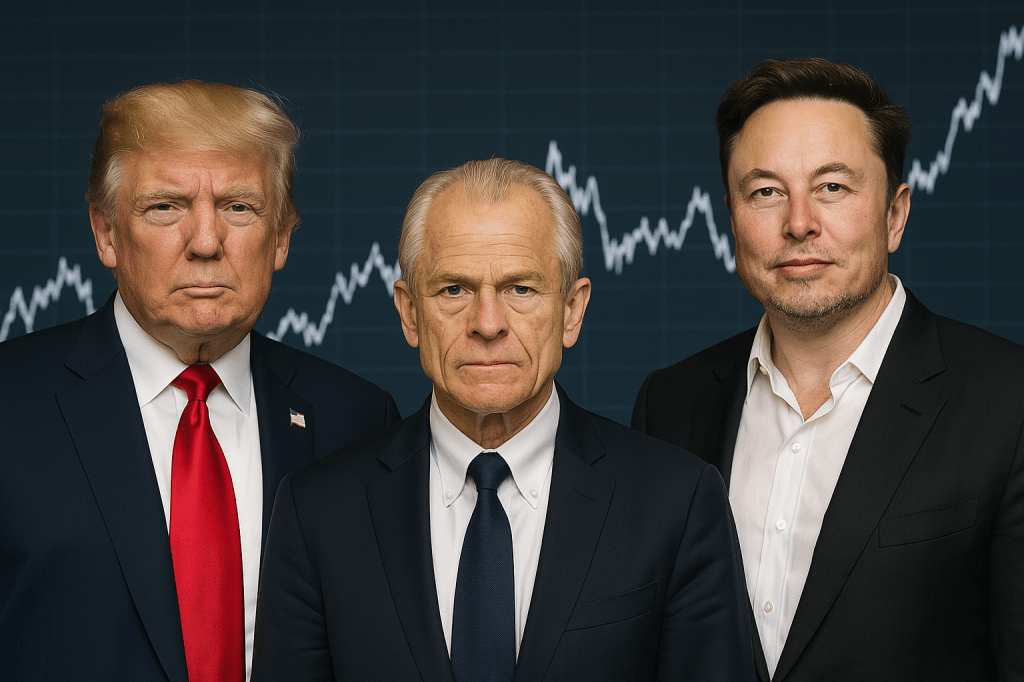

What began as a bold attempt by the Trump administration to force fairer trade terms has spiraled into an economic quagmire that is now hurting not just China and the United States, but Europe, Asia, and beyond. And as Scripture wisely reminds us in Proverbs 26:27, those who dig pits for others may end up falling into them themselves.

The Tariff Avalanche

The current phase of the trade conflict began with President Trump’s aggressive move to raise tariffs on Chinese goods to an astounding 104%. China swiftly retaliated with an 84% tariff on U.S. imports. What was once a calculated political maneuver has turned into an uncontrolled economic wildfire.

President Trump’s justification for these tariffs—protection of American industries and the reduction of trade imbalances—may sound noble, but the fallout tells a different story. According to Mark Zandi, chief economist at Moody’s Analytics, “Tariffs are simply taxes on American businesses and consumers. They raise costs, disrupt supply chains, and reduce competitiveness—all while failing to achieve long-term economic gains.” Instead of sparking domestic revitalization, these tariffs have stoked inflation, hurt American exporters, and led to panic across the global financial system.

Markets in Freefall

The markets have not responded kindly to these developments.

In the United States, the S&P 500 and Dow Jones Industrial Average plummeted by more than 10% in just two days, wiping out over \$6.4 trillion in market value. Treasury yields surged as bondholders fled in panic. Oil prices dropped by nearly 4% as fears of reduced global demand took hold. Major American corporations like Tesla, Walmart, and Apple have seen their valuations slashed, with some withdrawing earnings guidance entirely due to mounting uncertainty.

Meanwhile, across the Atlantic, European markets echoed the turmoil. The Stoxx 600 fell by 4%, and investor confidence—already fragile due to geopolitical instability and energy concerns—was further shattered.

In Asia, major indices tumbled as China’s retaliatory tariffs took effect. The selloff has been widespread, with both manufacturing hubs and emerging economies caught in the crossfire. The Australian Securities Exchange (ASX), heavily reliant on trade with China, experienced some of its sharpest losses in years. Similarly, the Philippine Stock Exchange Index (PSEi) plummeted by 4.3% on Monday, April 7, 2025, closing at 5,822.85—its lowest level since October 2022. This decline was part of a broader regional downturn fueled by escalating trade tensions between the U.S. and China, which intensified fears of a global recession.

This is not simply a case of market jitters. It is a systemic reaction to misguided policies and reckless escalation.

The Global Domino Effect

Why does a trade war between just two countries—albeit powerful ones—affect the whole world?

The answer lies in the interconnectedness of modern supply chains and global finance. For example, the U.S. semiconductor industry, which relies heavily on specialized manufacturing equipment and rare earth materials sourced from China, has seen project delays and increased costs due to retaliatory export controls. Likewise, the automotive sector has been disrupted as Chinese suppliers face heightened tariffs, making it harder for U.S. carmakers to obtain critical components affordably and on time. These disruptions highlight how deeply entwined international commerce has become—and how easily it can unravel when two economic giants lock horns. China and the United States together account for more than 40% of global GDP. Countless countries rely on both for imports, exports, and manufacturing inputs. When these two giants fight, their economic pain reverberates through every port, every factory, and every market on the planet.

Small and developing economies suffer disproportionately. Countries that supply raw materials to China or export agricultural goods to the U.S. face sudden demand shocks. International manufacturers are caught between rising costs and plummeting demand. Even sectors like tourism and education are affected as cross-border tensions rise.

In this environment, economic nationalism is not strength—it is vulnerability.

Bad Decisions, Bad Outcomes

At the heart of this crisis lies a failure of leadership and a misunderstanding of economic principles. Instead of pursuing multilateral reforms or leveraging diplomatic channels, the Trump administration has chosen a unilateral and combative path. The decision to impose sweeping tariffs without an exit strategy or meaningful engagement has backfired spectacularly.

The consequences are clear. Inflation is rising, markets are crashing, and international relationships are fraying. Even Elon Musk, controversially appointed to head the Department of Government Efficiency (DOGE), has been unable to stem the tide. His appointment has drawn mixed reactions both publicly and politically. Supporters cite his track record in private industry and believe his innovative mindset could bring efficiency to federal operations. However, critics point to his lack of government experience and raise concerns about conflicts of interest, especially given his leadership of companies that hold contracts with the U.S. government. Groups like Oxfam have called his role a sign of rising oligarchic influence in American democracy, while global protests have branded him an ‘unelected billionaire’ with undue influence over public institutions. His drastic cuts to the federal workforce may please some budget hawks, but they have done nothing to stabilize the broader economy.

As Proverbs 26:27 wisely warns, when you roll a stone with harmful intent, you may find it rolling right back at you.

Where Do We Go From Here?

There is still time to change course—but it requires humility, wisdom, and the willingness to admit mistakes. De-escalation must become the priority. Strategic dialogue with China, reinvestment in multilateral institutions, and a clear plan to stabilize markets are essential steps.

And perhaps more importantly, we must remember that economic policy is not just about numbers on a spreadsheet—it’s about people. Families are losing income. Businesses are closing. Investors are panicking. Behind every tariff is a worker, a farmer, or a retiree trying to survive.

Self-Inflicted Crisis

In a world groaning under the weight of wars, pandemics, and moral confusion, the last thing we need is a self-inflicted economic crisis. Yet here we are—watching as the world’s leading economies hurl stones and dig pits, forgetting that they too are standing on the edge.